BUSINESS - LIQUIDITY SOLUTIONS

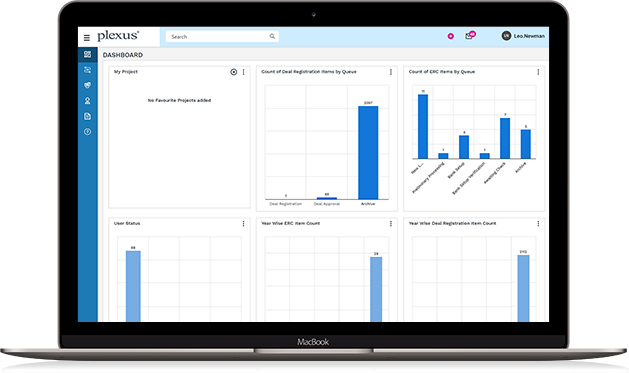

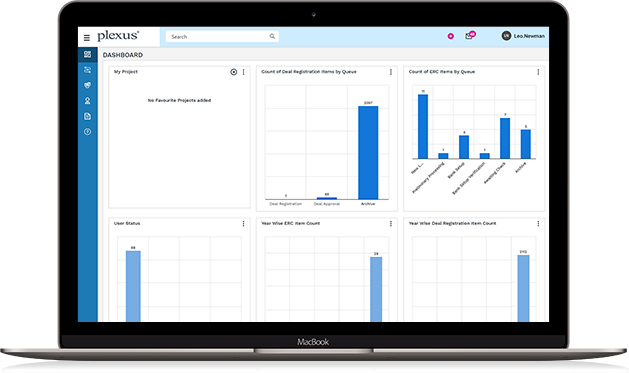

An automated multi-industry lending platform that provides a competitive marketplace for borrowers & lenders to transact based on their preferences.

Plexus Global serves the large & underserved lending market which is limited by high costs and lack of automation. Plexus Global’s automation enabled lending platform allows institutions to tap new markets, offering lenders the ability to focus on a particular sector.

The lending marketplace will allow institutional investors to register & utilize auto-invest algorithms to match their institution’s risk & sector preferences, allowing for portfolio diversification. The marketplace will consist of 5 borrowing sectors – Business (including ZLS), Mortgages, Personal, Government-sponsored & Auto.

Plexus Global emerged to address the large & under served lending market which is limited by high costs and lack of automation. Plexus Global’s automation enabled lending platform allows institutions to tap new markets, offering lenders the ability to focus on a particular sector. As a white-label product, Plexus Global is in discussion with banks and alternate liquidity providers that have expressed interest in the platform.

The lending marketplace will allow institutional investors to register and utilize auto-invest algorithms to match their institution’s risk & sector preferences, allowing for portfolio diversification. The marketplace will consist of 5 borrowing sectors:

- Business

- Mortgages

- Personal

- Government-sponsored

- Auto

Increase your cash flow for your business using Liquidity Solutions.

What you can do?

- Plexus Global’s proprietary credit decisioning system improves your score as you obtain more financing.

- As a lending institution, Plexus Global’s white label offering allows you to enter an underserved market that was lacking transparency.

- Plexus Global’s real time information system provides the borrower and lending institution a more transparent approach to Receivables Financing.

Key Features

Connect your accounting system to Plexus Global Liquidity solutions and start increasing cash flow in minutes.

As a lending institution review and approve borrowers and invoices using the Plexus Global Host account.

Utilise the ZLS Auto Invest solution; investors can set specific investment preferences and Plexus Global will go out and make those investments for you.

Coming Soon

Making mortgages easy; using automation to reduce your lending costs.

What you can do?

- Upload your financial records, connect your bank account and we can match you with a lender in no time at all.

- View and filter mortgage offers based on your preferences; you shop online for everything else, why not your mortgage?

- As an investor Plexus Global allows you to enter new markets and diversify your investments.

Key Features

Private connection to your bank account allows Plexus Global to perform in-house finance checks, without affecting your credit score.

Plexus Global Mortgage search allows you to create specific preferences based on your mortgage needs.

The investor dashboard provides analytics and insights into the types of mortgages invested in.

Coming Soon

Our automation systems connect you to lenders for the best rates on personal loans.

What you can do?

- Search for loans that meet your lending requirements.

- Diversify your portfolio- invest in loans to increase returns, use Auto Invest to manage your investment funds smarter.

- Borrowing and investing with Plexus Global is smarter and more transparent for both parties.

Key Features

Access your Plexus Global Personal account via our online portal, manage your loans anywhere, anytime.

Create specific search preferences and find personal loan rates on Plexus Global that you would never find on the high-street.

Using the Plexus Global Host account; lending institutions can leverage their existing customer base by automating your targeted email campaigns.

Coming Soon

Unlock cash from your government sponsored loans whether you’re a student, first time home buyer or small business.

What you can do?

- Convert your long term government sponsored loan into a short term financing option.

- Obtain financing from your government loan to invest and expand your business.

- Investors have a new opportunity to obtain returns by investing in a low risk government backed loan.

Key Features

Plexus Global’s proprietary credit scoring system allows your business to join the Plexus Global platform in seconds and does not run any personal credit checks.

Once approved onto the platform upload the loan you wish to get financing for; the Plexus Global Host and Investor will review your supporting documents and wire the funds in hours, not days or weeks.

The Plexus Global platform allows lending institutions to finance loans based on their risk preferences, allowing for a balanced portfolio.

Coming Soon

Bad credit history? Plexus Global can give you wheels; we match you to the best lenders for auto financing.

What you can do?

- A competitive marketplace to find car loans, Plexus Global connects you to lenders with great rates.

- Search and compare a number of loan options based on your auto needs.

- Lending institutions are able to enter into a new market, using the Plexus Global White Label solution there will be no implementation costs, through the use of non-evasive technology.

Key Features

Get financing for your new car in no time. Connect your bank account and let Plexus Global do the hard work, we will match you with a lender in minutes.

Enter your specific auto loan requirements, Plexus Global will go out to the market and find the best lender for you.

Plexus Global White Label is a cloud based application and allows you to enter new lending markets with a lower cost.

Business

Business

Increase your cash flow for your business using Liquidity Solutions.

What you can do?

- Plexus Global’s proprietary credit decisioning system improves your score as you obtain more financing.

- As a lending institution, Plexus Global’s white label offering allows you to enter an underserved market that was lacking transparency.

- Plexus Global’s real time information system provides the borrower and lending institution a more transparent approach to Receivables Financing.

Key Features

Connect your accounting system to Plexus Global Liquidity solutions and start increasing cash flow in minutes.

As a lending institution review and approve borrowers and invoices using the Plexus Global Host account.

Utilise the ZLS Auto Invest solution; investors can set specific investment preferences and Plexus Global will go out and make those investments for you.

Mortgages

Mortgages

Coming Soon

Making mortgages easy; using automation to reduce your lending costs.

What you can do?

- Upload your financial records, connect your bank account and we can match you with a lender in no time at all.

- View and filter mortgage offers based on your preferences; you shop online for everything else, why not your mortgage?

- As an investor Plexus Global allows you to enter new markets and diversify your investments.

Key Features

Private connection to your bank account allows Plexus Global to perform in-house finance checks, without affecting your credit score.

Plexus Global Mortgage search allows you to create specific preferences based on your mortgage needs.

The investor dashboard provides analytics and insights into the types of mortgages invested in.

Personal

Personal

Coming Soon

Our automation systems connect you to lenders for the best rates on personal loans.

What you can do?

- Search for loans that meet your lending requirements.

- Diversify your portfolio- invest in loans to increase returns, use Auto Invest to manage your investment funds smarter.

- Borrowing and investing with Plexus Global is smarter and more transparent for both parties.

Key Features

Access your Plexus Global Personal account via our online portal, manage your loans anywhere, anytime.

Create specific search preferences and find personal loan rates on Plexus Global that you would never find on the high-street.

Using the Plexus Global Host account; lending institutions can leverage their existing customer base by automating your targeted email campaigns.

Government-Sponsored

Government-Sponsored

Coming Soon

Unlock cash from your government sponsored loans whether you’re a student, first time home buyer or small business.

What you can do?

- Convert your long term government sponsored loan into a short term financing option.

- Obtain financing from your government loan to invest and expand your business.

- Investors have a new opportunity to obtain returns by investing in a low risk government backed loan.

Key Features

Plexus Global’s proprietary credit scoring system allows your business to join the Plexus Global platform in seconds and does not run any personal credit checks.

Once approved onto the platform upload the loan you wish to get financing for; the Plexus Global Host and Investor will review your supporting documents and wire the funds in hours, not days or weeks.

The Plexus Global platform allows lending institutions to finance loans based on their risk preferences, allowing for a balanced portfolio.

Auto

Auto

Coming Soon

Bad credit history? Plexus Global can give you wheels; we match you to the best lenders for auto financing.

What you can do?

- A competitive marketplace to find car loans, Plexus Global connects you to lenders with great rates.

- Search and compare a number of loan options based on your auto needs.

- Lending institutions are able to enter into a new market, using the Plexus Global White Label solution there will be no implementation costs, through the use of non-evasive technology.

Key Features

Get financing for your new car in no time. Connect your bank account and let Plexus Global do the hard work, we will match you with a lender in minutes.

Enter your specific auto loan requirements, Plexus Global will go out to the market and find the best lender for you.

Plexus Global White Label is a cloud based application and allows you to enter new lending markets with a lower cost.